Make A Report

TRAFFIC REPORTS

Serious Collisions, Self-Reports, and Complaints

If you are in a car crash involving any of the following, you must contact law enforcement to submit a crash report.

Please stay at the scene and call (850) 606-5800, or for emergencies call or text 9-1-1.

- A crash with injury

- A crash with fatality

- A hit and run crash

- A DUI crash

- A crash which requires a wrecker to remove the vehicle

- A crash with a commercial motor vehicle

- A crash where apparent damage is at least $500.00

If the accident does not meet the above listed criteria, you can fill out a self-report with Florida Highway Safety and Motor Vehicles.

Self-reports must be submitted to the Florida Department of Highway Safety and Motor Vehicles within 10 days of the incident. Completed forms may be sent digitally via email, or hardcopies can be sent through the mail.

Crime Report

If you are experiencing an emergency and need help immediately, call or text 9-1-1. For non-emergencies, review options below.

To report a non-emergency incident that occurred within City limits of Tallahassee, you may:

- Request a police officer to respond to your location

- File a report in person at the Police Department

- File a report online

Call the Tallahassee Police Department at (850) 891-4200 or (850) 891-4387 for a TPD Duty Officer or contact the CDA at (850) 606-5800.

To report a non-emergency incident that occurred in Leon County but outside the City limits of Tallahassee, you may:

- Request a deputy to respond to your location

- File a report in person at the Leon County Sheriff’s Office

- File a report online

Call the Leon County Sheriff’s Office at (850) 606-3300 or (850) 606-3322 for a LCSO Duty Officer or contact the CDA at (850) 606-5800.

*If the incident you wish to report did not occur within the City of Tallahassee or Leon County, contact the law enforcement agency with jurisdictional authority where the incident occurred.

*If the incident occurred on the interstate, contact the Florida Highway Patrol at (850) 245-7700 (dial #347 from a cellular phone or call the Tallahassee Florida Highway Patrol station at (850) 410-3046.

Are you seeking assistance with trespassing issues?

The best ways to help law enforcement help you with trespassing issues are to complete a “Blanket Trespass Warning Authorization” form and properly post your property.

For the definitive guide on Florida’s trespassing laws and proper posting, refer to Chapter 810, Florida Statutes.

If you live within the City limits of Tallahassee, please contact the Tallahassee Police Department. (850) 891-4200.

If you live in Leon County (outside city limits), please contact the Leon County Sheriff’s Office. (850) 606-3300.

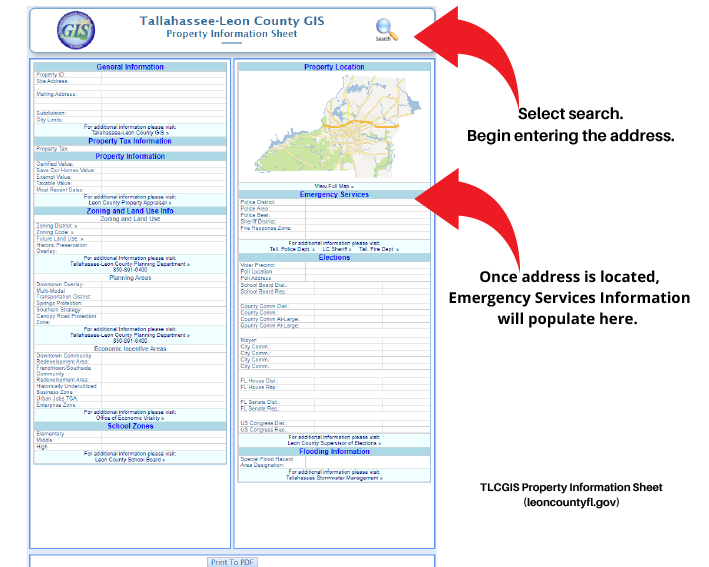

If you are unsure whether the incident location is within the City limits of Tallahassee or outside the city limits, utilize the Tallahassee-Leon County GIS Property Information Sheet found here TLCGIS Property Information Sheet (leoncountyfl.gov) . See below for assistance.

Tax-Related Identity Theft

You may not know you are a victim of identity theft until you are notified by the Internal Revenue Service (IRS) of a possible issue with your return.

Be alert to possible tax-related identity theft if:

- You get a letter from the IRS inquiring about a suspicious tax return that you did not file.

- You cannot file your tax return because of a duplicate Social Security number.

- You receive a transcript in the mail that you did not request.

- You receive an IRS notice that an online account has been created in your name.

- You receive an IRS notice that your existing online account has been accessed or disabled when you took no action.

- You receive an IRS notice that your own additional tax or refund offset, or that you have had collection actions taken against you for a year you did not file a tax return.

- IRS records indicate you received wages or other income from an employer for whom you did not work.

- You have been assigned an Employer Identification Number (EIN) but did not request an EIN.

If your social security number is compromised and you know or suspect you are a victim of tax-related identity theft, the IRS recommends these actions:

- Respond immediately to any IRS notice: Call the number provided.

- If your e-filed return is rejected because of a duplicate filing under your Social Security number, or if the IRS instructs you to do so, complete IRS Form 14039, Identity Theft Affidavit (Form 14039 (Rev. 12-2022) (irs.gov) ). Use a fillable form at IRS.gov, print, then attach the form to your return and mail your return according to instructions.

- Visit IdentityTheft.gov to file a report and get a recovery plan!

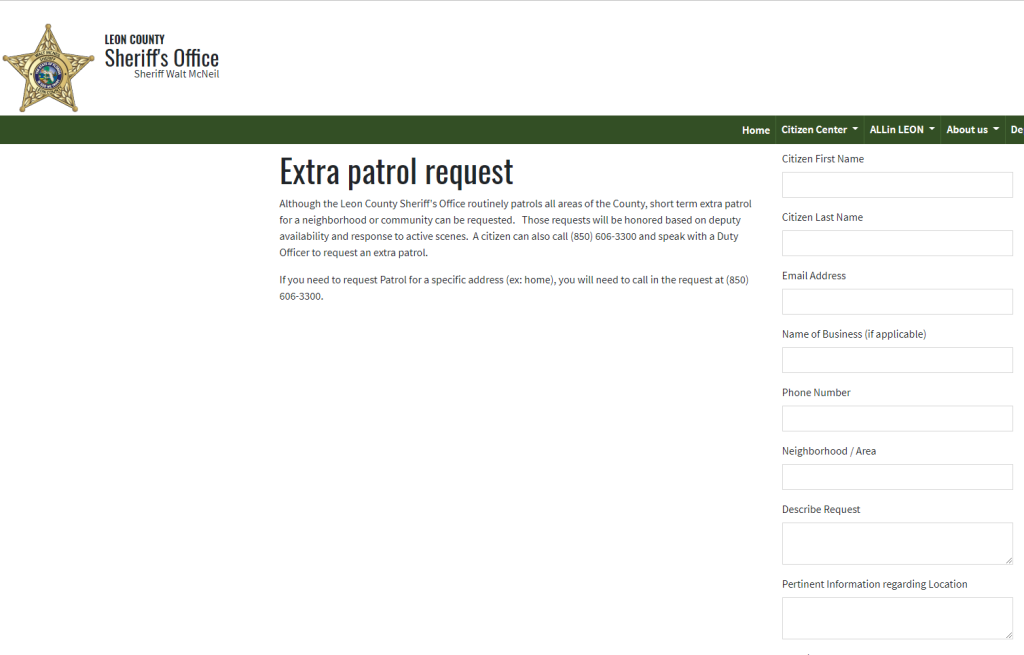

Extra Patrol

To request Extra Patrol in the City of Tallahassee, you may do so here, TPD | Crime Prevention & Safety | Public Safety (talgov.com) , or by calling the TPD Community Relations Unit at 850-891-4251 or via email at tpdcp@talgov.com . Extra Patrol is based on officer availability and response to active scenes.

To request Extra Patrol in the County, you may do so here, Extra patrol request (leoncountyso.com) , or by calling the LCSO Duty Office at 850-606-3300. Extra Patrol is based on deputy availability and response to active scenes.